Part 2 of 12 – The Basics – MORTGAGE BROKERS – Getting into home-ownership or property investment

The Basics – Part 2 of 12 – Mortgage Brokers

Before I start explaining how to buy your first home, become a landlord or how to become a property developer, you’ll need to understand some of the basics first, otherwise, you’re likely to find the whole process confusing and perhaps stressful, especially when using unorthodox strategies to buy a home or property investment, typically for those with a lack of funds and/or good credit rating.

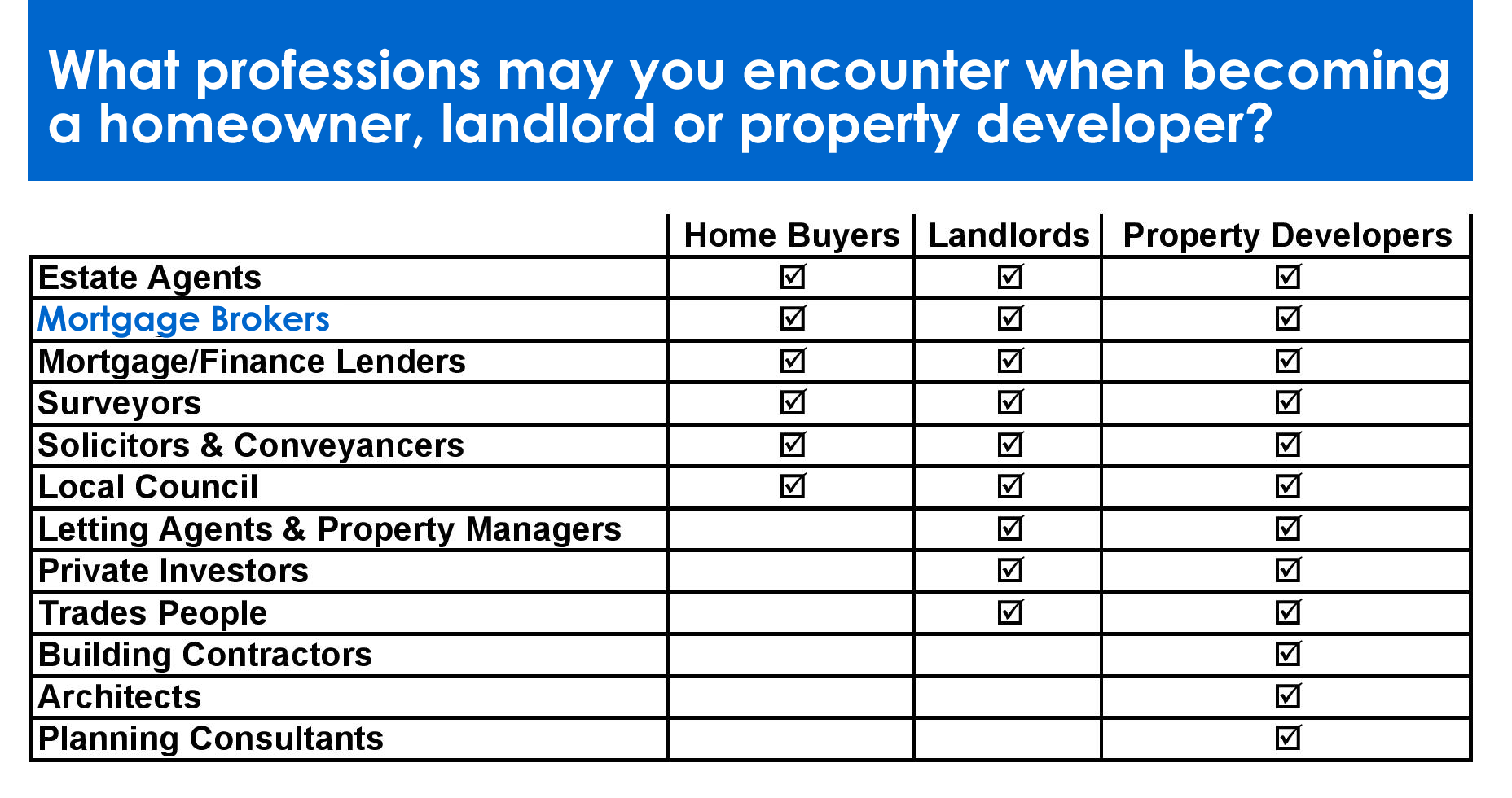

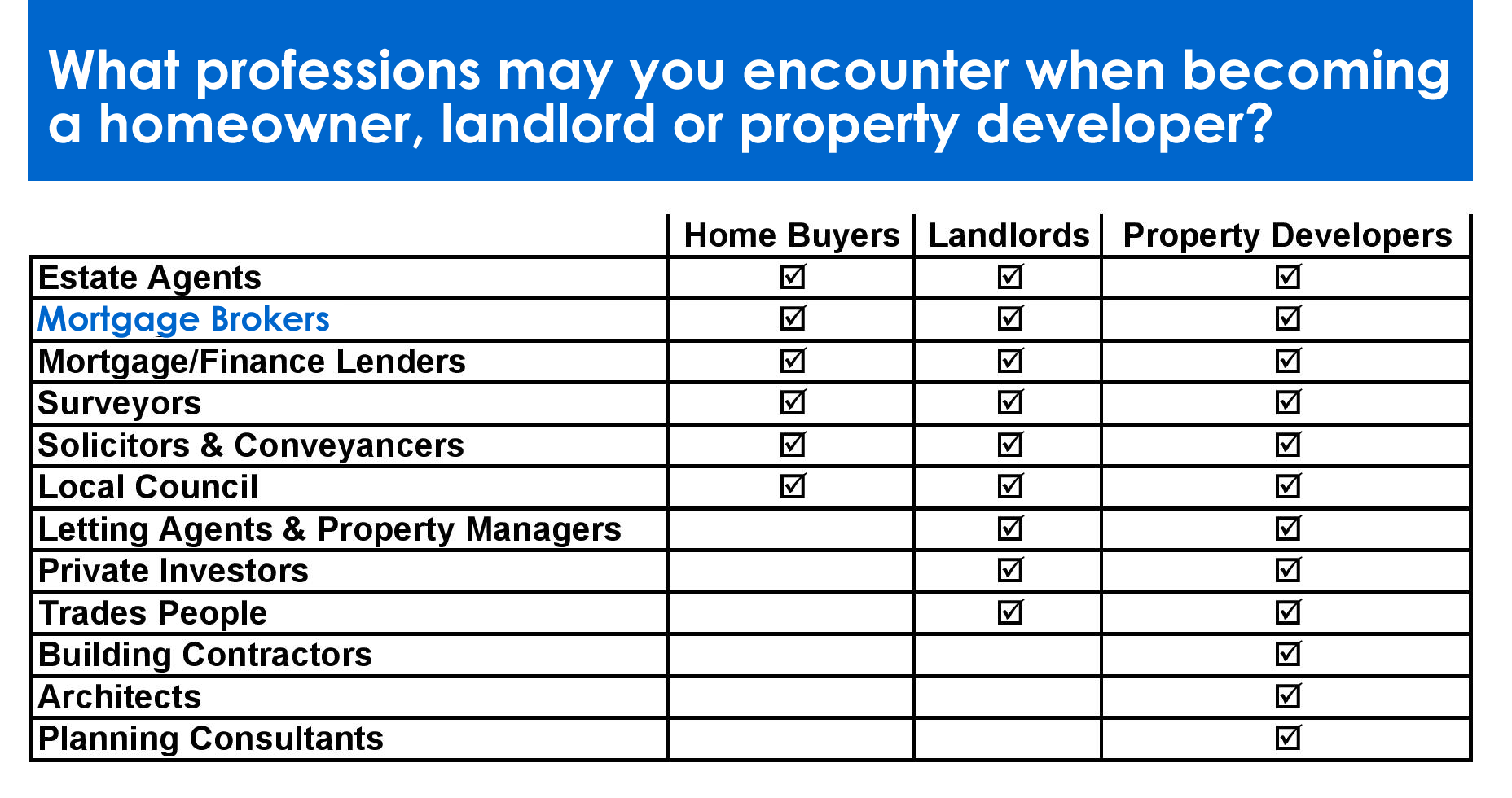

Throughout your property journey, you’re going to encounter a number of different professionals, which ones will depend on whether you intend on becoming a homeowner, landlord or property developer. Here’s part 2 of 12 on MORTGAGE BROKERS.

MORTGAGE BROKERS

Mortgage brokers can help you get the right mortgage, or not. Expect to pay them a fee for mortgage advice and then they’ll get paid again by the mortgage lender if they successfully get the money for you. Request a copy of their terms from the outset to avoid being sent an invoice for their time if you decide not to use them. In an ideal world, you find a broker that will only charge you once they’ve obtained a mortgage offer on your behalf. If there is a small fee to cover their time in the event of you changing your mind then this is not unreasonable.

If you can’t get a mortgage right now then you still need to know the role that mortgage brokers play in the buying process. It’s actually very important to get a good broker and this is no easy feat. Many of them nowadays simply enter your details into a system which then chucks out a few different lending products for you to consider. Aside from a broker having access to a wide panel of mortgage lenders and products, you need a broker that has a deep understanding of lenders criteria and the process of the lenders underwriters. This will potentially avoid failed applications and aborted valuation costs. You’ll also want to select your broker based on the type of property you’re intending to purchase. This is because there are specialist brokers that should be used for specialist cases, such as help-to-buy applications, homes of multiple occupancy, bridging loans and development finance, to name a few. Estate agents are often paid commission to introduce you to a mortgage broker so don’t expect to get a good one just because an agent is recommending one to you.